LEARN MORE

Community Resource Specialists are available between 8 a.m. to 5 p.m. M-F at (408) 350-3200, option 1.

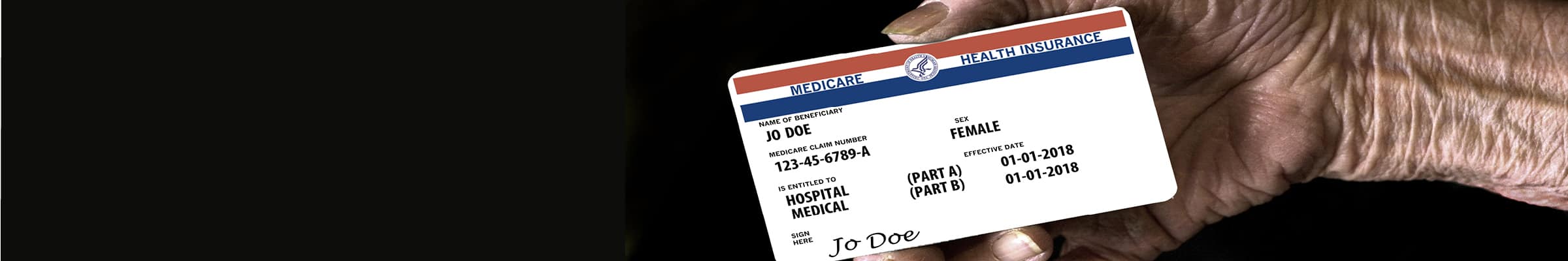

Health Insurance Counseling & Advocacy Program

Sourcewise provides residents of Santa Clara County access to one-on-one counseling to assist Medicare beneficiaries, their families, and caregivers understand their Medicare benefits and healthcare options.

If you reside outside of Santa Clara County, please visit California Health Advocates (CHA) for your local HICAP office.

If you reside outside of California, please visit State Health Insurance Assistance Program (SHIP) for your local SHIP office.

Who We Serve

We know that understanding Medicare can be challenging.

HICAP services are available to current Medicare beneficiaries living in Santa Clara County; those about to become eligible for benefits; and anyone who wants to learn more about buying health insurance while planning for retirement.

HICAP also serves as advocates for families of seniors or service providers.

HICAP is part of the national network of State Health Insurance Assistance Program (SHIP) and is the Santa Clara County source for unbiased and objective Medicare-related counseling and information.

We are here to help if you or someone you know is a Medicare beneficiary or about to become one. Some Medicare basics include:

- Generally, individuals age 65 and over can have Medicare Part A benefits

- Persons with disabilities under age 65 can have Medicare Part A benefits after the 24th month of receiving Social Security disability benefits or Railroad Retirement disability benefits. A person with ALS (Amyotrophic Lateral Sclerosis/Lou Gehrig’s disease) would get Medicare A the month disability benefits start

- Individuals with permanent kidney failure at any age can have Medicare Part A

Any person who is eligible for Medicare Part A is also eligible for Medicare Part B.

To have Medicare, individuals described above must also be U.S. citizens or be lawfully admitted and then continuously live in the U.S. for five years. Such noncitizens should contact HICAP before their fifth year of permanent residency status.

Let’s Get Started

Find out what your options are and what will work best for you. The Health Insurance Counseling & Advocacy Program will help you fully understand your Medicare options so that you can make the right choices and navigate the Medicare maze better informed.

HICAP answers questions about:

- Original Medicare, Part A & Part B

- Medicare Supplemental Insurance (Medigap)

- Medicare Advantage Plans

- Medicare Prescription Drug Coverage

- Limited income programs that help with Medicare costs

- Choices for dually eligible Medicare and Medi-Cal beneficiaries

- Medicare coordination with other insurance, (e.g. employer and retiree plans)

- Long-Term Care Insurance

- Medicare Fraud and Abuse

Contact HICAP if you are interested in:

- A one-on-one Medicare or long-term care insurance counseling session

- Hosting or attending a Medicare or long-term care insurance presentation or seminar

- Inviting Sourcewise HICAP to participate in an outreach event

Not sure where to begin?

To schedule an appointment, contact our Community Resource Specialists at (408) 350-3200, option 1.

For Medicare-related questions, complete the HICAP Interest Form.

Presentations & Outreach Events

Medicare and long-term care insurance presentations are available to various groups and organizations upon request. If you and your group would like to host a presentation on a Medicare topic or have HICAP attend your outreach event, contact HICAP Community Outreach & Education Specialist, Steven Rubalcaba. HICAP does not sell, recommend, or endorse any insurance product.

Medicare and long-term care insurance presentations are available to various groups and organizations upon request. If you and your group would like to host a presentation on a Medicare topic or have HICAP attend your outreach event, contact HICAP Community Outreach & Education Specialist, Steven Rubalcaba. HICAP does not sell, recommend, or endorse any insurance product.

Volunteer Opportunities with HICAP

Become a Volunteer Counselor with the Health Insurance Counseling & Advocacy Program.

Volunteer counselors commit to at least 40 hours of service a year. They first complete approximately 30 hours of Medicare training, and a minimum of 10 hours of internship to become a registered Health Insurance Counseling & Advocacy Program Counselor.

HICAP Volunteers cannot be licensed insurance agents, insurance brokers, or financial planners.

If you’re interested in becoming a registered Health Insurance Counseling & Advocacy Program Counselor, please complete the HICAP Screening Questions. Alternatively, you can contact the HICAP Volunteer Coordinator by calling (408) 350-3245 or emailing hicapinterest@mysourcewise.com.

Medicare Consumer Guide

Sourcewise offers a Medicare Consumer Guide. It is used in conjunction with one-on-one telephone or in-person counseling sessions with our counselors to assist you in making informed health care decisions.

Medicare Resources:

- Social Security Administration: ssa.gov

- Medicare: medicare.gov

- Medi-Cal: dhcs.ca.gov

- Medi-Cal for providers: medi-cal.ca.gov

- Social Services Agency website: sccgov.org

- Coordinated Care Initiative and the Cal MediConnect duals demonstration project: calduals.org

- Benefits Coordination and Recovery Center phone number: 1 (855) 798-2627

- Department of Veterans Affairs phone number: 1 (844) 698-2311

- Federal Employee Health Benefits Program website: opm.gov

- Livanta, Quality Improvement Organization website: livantaqio.com

- Introduction to Medicare presentation recording

This project was supported, in part, by grant number CFDA 93.324 from the U.S. Administration for Community Living, Department of Health and Human Services, Washington D.C. 20201. Grantees undertaking projects under government sponsorship are encouraged to express freely their findings and conclusions. Points of view or opinions do not, therefore, necessarily represent official Administration for Community Living policy.

Support was provided by the California Department of Aging.