Many people expect to stay in their homes as they get older but have not made plans to accomplish this goal. To ensure a secure retirement, consider long-term care insurance; home modifications; and financial strategies to age comfortably at home.

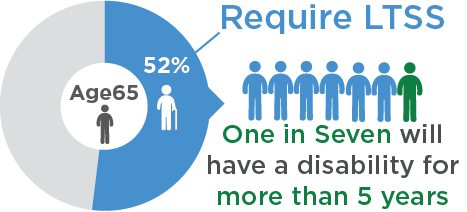

According to the U.S. Department of Health and Human Services, most Americans underestimate the risk of developing a disability and needing long-term services and supports (LTSS). An estimated 52% of Americans turning 65 today will develop a disability serious enough to require LTSS. Although most will need assistance for less than two years, about one in seven adults will have a disability for more than five years.

A recent study by the U.S. Department of Health and Human Services reports that 8% of Americans have long-term care insurance. Insurance of this type helps with expenses related to activities of daily living and personal care. Most Americans pay for these services out of pocket, since Medicare only pays for skilled or rehabilitative services.

Because mobility decreases with age, accessibility modifications may gradually be needed. Safety enhancements accommodate changing physical needs and can include anything from grab bars and nonslip rugs to more costly options such as installing a chair lift or a walk-in tub.

Financial strategies are necessary to prioritize expenses arising with increasing needs. Home modifications; increased healthcare expenses; and in-home caregivers can be expensive. Investigate options such as an annuity (a contract with an insurance company to allocate money that is later distributed back to the person over time) or a reverse mortgage to assist with future expenses.

Contact a Community Resource Specialist to find help with long-term care insurance questions; home modifications; and financial strategies: (408) 350-3200, option 1.