This tax season, American taxpayers age 65 and older may benefit from using a new form created specifically to assist the senior population with filing and paying their taxes. The newly designed form 1040-SR U.S Tax Return for Seniors is available for use by seniors filing their 2019 taxes.

This tax season, American taxpayers age 65 and older may benefit from using a new form created specifically to assist the senior population with filing and paying their taxes. The newly designed form 1040-SR U.S Tax Return for Seniors is available for use by seniors filing their 2019 taxes.

The creation and publication of the 1040-SR form is a result of a Congressional mandate to the Internal Revenue Service (IRS). The mandate from Congress was enacted by the Bipartisan Budget Act of 2018 which stated the IRS must allow seniors the ability to easily file their taxes without the benefit from an accountant.

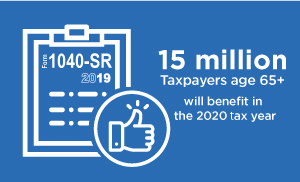

During the 2020 tax season, the 1040-SR is estimated to prove beneficial to at least 10% of 150 million American taxpayers. To be eligible to use this form, seniors must be age 65 or above prior to January 2, 2020 and those who do not plan on itemizing taxes due to state and local taxes or charitable donations.

This form was specifically designed with older American taxpayers in mind as it incorporates updates based on the feedback shared by senior taxpayers, and it features the following improvements:

- Seniors may receive much of their annual income from capital gains

- Seniors file taxes by themselves without benefit from an accountant

- A simpler way to configure and pay taxes, including the option to file by paper rather than electronically

- Fillable lines for specific retirement income streams, such as Social Security benefits, Individual Retirement Account (IRA) distributions, pensions, and annuities

- Large print for reading and comprehension

- A cleaner space around text boxes that brightens the form, as the shading in the previous form made it difficult to use

- Inclusion of the Standard Deductions Chart for easy reference

- Seniors can claim a child tax credit if they care for a dependent child or grandchild

Learn more about taxpayer resources. Contact a Sourcewise Community Resource Specialist: (408) 350-3200, option 1.